tax avoidance vs tax evasion philippines

Tax avoidance and tax evasion are two terms that must be clearly understood by responsible individuals and companies who are earn money especially in the Philippines. While you get reduced taxes with tax avoidance tax evasion can result in.

Pdf Tax Evasion In The Philippines 1981 1985

Your Role as a Taxpayer Lesson 3.

. This crime typically involves purposefully hiding money from the IRS. Tax books have often defined tax avoidance as an attempt to minimize the payment or altogether eliminate tax liability by lawful means while tax. Where you can run into trouble is how you go about decreasing your tax bill.

Anyone would like to pay less for taxes but it is a social and national responsibility to do so. Delaying or postponing the sale of a capital asset until after 12 months to reduce the tax on capital gains to 50. Tax evasion on the other hand involves schemes outside those lawful means that when resorted.

This thread is archived. Under-reportingof income over-statementof expenses use of fictitious. Tax avoidance is the use of tax-saving devices within the means sanctioned by law and where the taxpayer acts in good faith and at arms length.

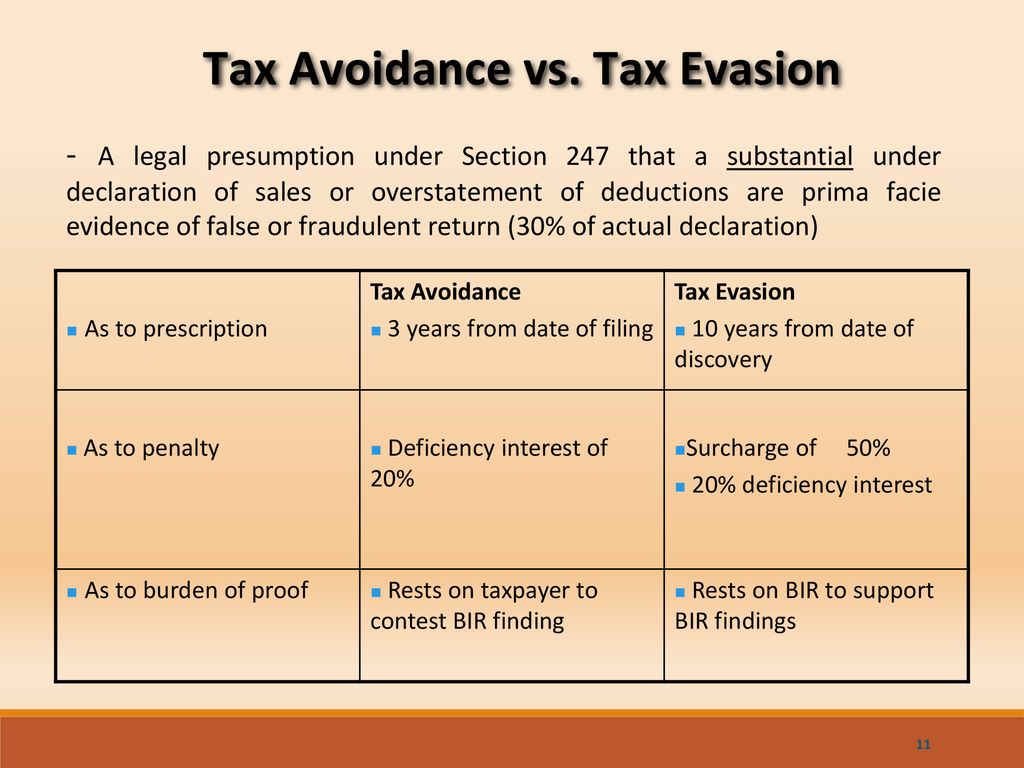

The terms tax avoidance and tax evasion a. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of. If the cost of evasion and avoidance depends on other aspects of behavior the choice of consumption basket and avoidance become intertwined.

Avoidance with the additional risk bearing caused by tax evasion either being a special case of this technology or one aspect of the cost of changing behavior to reduce tax liability. These methods of diverting your money are legal ways to lower your tax burden. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments.

Tax avoidance is the use of tax-saving devices within the means sanctioned by law and where the taxpayer acts in good faith and at arms length. Key Differences between Tax Evasion vs Tax Avoidance. Tax evasion means concealing income or information from tax authorities and its illegal.

In tax avoidance youre making use of your tax benefits to lower taxes for your small business. Underground economyMoney-making activities that. Let us discuss some of the major differences between Tax Evasion vs Tax Avoidance.

As it currently stands simply avoiding tax is perfectly legal but crossing the line into evading tax can result to hefty fines and prosecution and it is very easy for the former to turn into the latter. Using tax deductions itemized deductions on Sch A business expenses on Sch C or Form 2106 to reduce your taxable incomeTax evasion. Tax evasion on the other hand is a scheme used outside of those lawful means and when availed of it usually subjects the taxpayer to further or additional civil or criminal liabilities.

The biggest difference between the two is that tax avoidance is completely legal. Tax avoidance aka tax minimization is a way taxpayers minimize their taxes through legally permissible means meaning it is not punishable by law. Tax evasion may be defined as the act of reducing taxes by illegal or fraudulent means1Common practices of tax evasion include.

Tax Evasion Cases In The Philippines. Theres nothing wrong with wanting to pay less in taxes. In tax evasion you hide or lie about your income and assets altogether.

Difference Between Tax Evasion and Tax Avoidance. Bir Files Tax Evasion Cases Vs Actor Richard Gutierrez Manila Bulletin As the old adage goes taxes are a fact of life. According to the court tax avoidance is a tax-saving device within the means sanctioned by law.

However you should still declare these assets to the IRS to avoid undue scrutiny or false allegations of tax evasion. The Government of any country offers areas and multiple. But failing to pay or deliberately underpaying your taxes is tax evasion and its illegal.

Tax Evasion vs. Tax evasion on the other hand involves schemes outside those lawful means that when resorted to by taxpayers usually subjects them to civil or criminal liabilities in addition to penalties and interest on the unpaid. Tax evasion and tax avoidance.

In tax avoidance you structure your affairs to pay the least possible amount of tax due. Therefore mistakes that are made in good faith cant constitute tax evasion or tax fraud because the actor didnt intent to cheat on. There are legitimate tax avoidance steps you can take to maximize your after-tax income.

Businesses get into trouble with the IRS when they intentionally evade taxes. Tax avoidance means legally reducing your taxable income. The difference between tax avoidance and tax evasion boils down to the element of concealing.

Tax evasion aka tax dodging is done with the deliberate intention of reducing or. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes. Tax evasion is the avoidance of tax by unlawful means ie the taxpayer pays less tax than he is legally obligated to pay.

TAX EVASIONTax avoidance. Tax Evasion vs. Tax evasion can be carried out by the omission of taxable income or transactions from tax declarations failure to file a return sham transactions or reduction Of the amount properly due by.

Tax evasion on the other hand is a crime that could undermine your financial well-being. Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1. Basically tax avoidance is legal while tax evasion is not.

In tax evasion youre deliberately reducing your tax liability by lying or omitting numbers when you file your taxes. Tax Evasion vs. To escape the tax net may take any one of two forms.

The Taxpayers Responsibilities Key Terms tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. But your business can avoid paying taxes and your tax preparer can help you do that. Claiming erroneous tax deductions.

THE LEGALITY OF THE ASSAULT ON TAX AVOIDANCE PRACTICES IN THE PHILIPPINES Evelyn Kho-Sy The distinction between tax avoidance and tax evasion is very clear in the academe. It should be used by the taxpayer in good faith and at arms length. Tax Avoidance While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to.

Tax evasionThe failure to pay or a deliberate underpayment of taxes. When you want to lessen your taxes you may want to resort to tax avoidance instead of tax evasion. Thats how you can ethically and.

Thats why you would want to do tax avoidance. The difference between tax avoidance and tax evasion substantially comes down to legality.

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

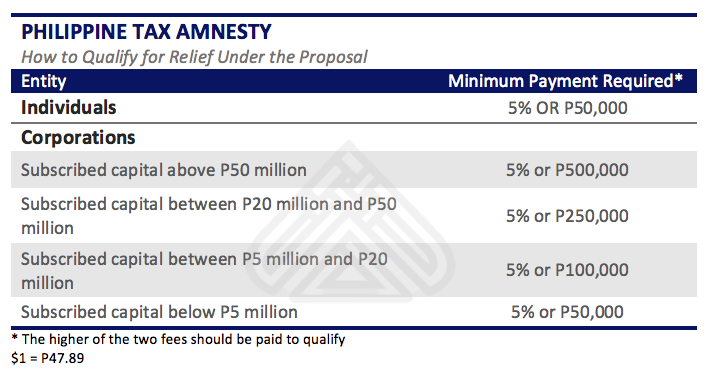

Philippine Tax Amnesty Proposed In A Bid To Increase Revenue Collection

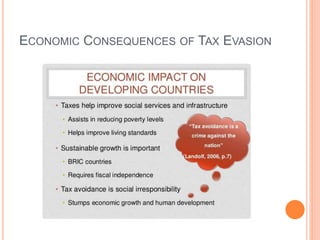

Tax Evasion And Tax Avoidance Parliamentary Days 2014

False List Of Philippines Biggest Tax Evaders

How To Reduce Your Tax Legally And Ethically Ppt Download

Mon Abrea Tax Evasion Vs Tax Avoidance Do You Want To Facebook

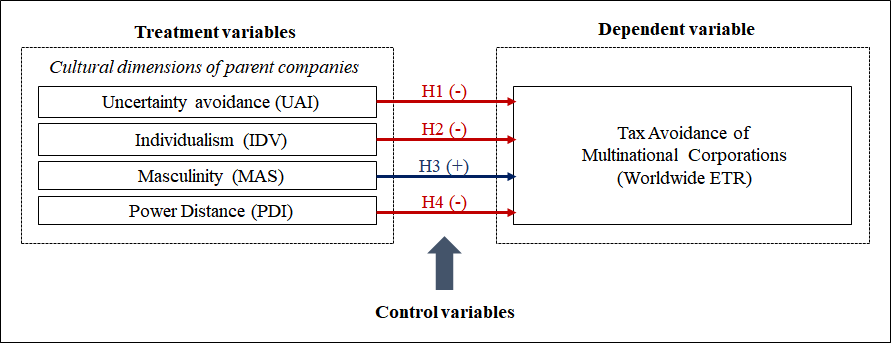

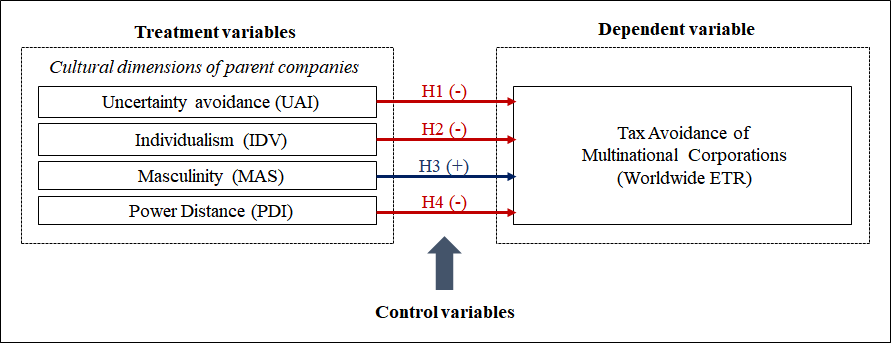

Sustainability Free Full Text National Culture And Tax Avoidance Of Multinational Corporations Html

Cross Border Tax Avoidance And Evasion A Developing Asia Perspective International Tax Review

False Abs Cbn S Effective Tax Rate In 2018 Was At Negative 5

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Tax Avoidance And Tax Evasion What Are The Differences

Difference Between Tax Avoidance And Tax Evasion Youtube

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics Tax Saving Investment Tax Business Valuation

Tax Avoidance Vs Tax Evasion The Big Difference Taxes Taxplan How To Plan Tax Services Tax